FNSPID: A Comprehensive Financial News Dataset in Time Series

https://arxiv.org/pdf/2402.06698

0. Abstract

Background in financial market prediction

- [Traditional] Reliance on quantitative factors

- [Recent] + Sentiment data from financial news (feat. LLM)

Limitations of Existing Approaches

- (1) Lack of large-scale datasets

- (2) Insufficient alignment of numerical & sentiment data

[Proposed] FNSPID

- tldr; Financial News & Stock Price Integration Dataset

- Large-scale & time-aligned financial data

- [TS] 29.7M stock price

- [Text] 15.7M financial news

- Coverage

- 4,775 S&P 500 companies

- Time span: 1999–2023

- Sources: 4 stock market news websites

Key Properties

- Larger scale & Higher diversity

- Explicit inclusion of sentiment information

Findings

- a) Dataset size & quality \(\rightarrow\) Improve prediction accuracy

- b) Sentiment scores \(\rightarrow\) Uield modest gains for transformer-based models

1. Introduction

TS regression

- Fundamental to financial forecasting

- For both traditional finance & AI-based financial modeling

Classical financial models

- (e.g., Fama–French Three-Factor Mode, Arbitrage Pricing Theory)

- Rely on linear regression and historical data

- Limitation: Struggle to anticipate market extremes & unprecedented events (e.g., financial crises)

ML/DL methods

- Outperforming traditional models

- Benefit from integrating stock prices with news sentiment

Modern portfolio theory

- Emphasizes market correlations

- Recent studies: Show strong links between sentiment data & stock trends

LLMs in finance

- Multimodal approaches

- Combine numerical & textual data \(\rightarrow\) improve accuracy

- Significantly improve sentiment analysis

- Limitation:

- Information loss from sentiment-only representations

- Lack of large, integrated datasets

Limitation of Existing financial news datasets

- Lack sufficient scale

- Lack aligned stock price data

- Unstructured news formats hinder their use in seq2seq TS modeling

Proposal: Financial News and Stock Price Integration Dataset (FNSPID)

-

Uniquely aligns TS news & Stock prices

-

Contribution

-

(1) Integrating textual & numerical data

- (2) Experiments using FNSPID

-

a) Larger datasets

-

b) High-quality sentiment information

\(\rightarrow\) Enhances forecasting accuracy

-

- (3) Facilitates research in …

- Sentiment analysis

- LLM fine-tuning …

-

2. Related Works

(1) Evolution of Financial Analysis Models

a) Classical factor models

- (e.g., Fama–French Three-Factor Model, Arbitrage Pricing Theory)

- Incorporate factors such as market risk, size, and value

- Strength & Limitation

- [Strength] Effective for long-term asset pricing analysis

- [Limitation] Lack granularity for short-term forecasting (e.g., price peaks and troughs)

b) Statistical TS models

- (e.g., ARIMA, GARCH)

- Widely used for market trend & volatility analysis

- [Limitation] Sensitive to investor subjectivity and behavioral bias

c) ML/DL in finance

- Improves market entry and exit timing

- Evolution:

- Classical ML: Linear Regression, SVM

- Advanced ML/DL: LSTM, RNN, Deep Q-learning

- Reinforcement learning shows promise for trading strategies

d) Data-driven ML/DL advantages

- Leverages heterogeneous data sources

- Real-time news

- Social media sentiment

- Economic indicators

- [Strength]

- Capture non-linear patterns

- Adapt to changing market conditions

e) Role of financial news and sentiment

- Financial news: Strongly influences market movements

- GARCH-based studies: Highlight impact during financial crises

- Sentiment + ML integration:

- Enhances prediction accuracy

- Applied to volatility prediction and relational market analysis

- Limitation of prior work:

- Lack of real-time data

- Limited use of detailed financial metrics

- Neglect of individual investor behavior

f) Pre-trained language models and LLMs

- (e.g., GPT-3.5, FinGPT)

- Used for:

- Generating financial news

- Sentiment-based stock prediction

- Outperform traditional sentiment analysis methods

- Demonstrated strong sentiment–price correlation

g) LLMs for TS forecasting

- Backbone LLMs show strong potential in TS prediction

- Limitation: Scarcity of large, high-quality financial datasets

- Indicates untapped capability of LLMs for financial market applications

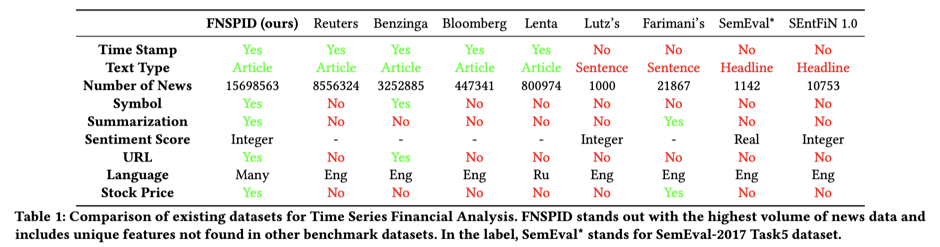

(2) Existing Stock Dataset

a) Existing stock market datasets

- DL-based sentiment analysis: Performance strongly depends on data volume and quality

- Growing research focus on integrating news sentiment + stock prices

b) Early sentiment-focused datasets

- Lutz dataset

- Binary, sentence-level sentiment (positive / negative)

- Text-only financial news

- Limitation: No company-level financial data

- Cortis dataset

- Fine-grained sentiment for financial news and microblogs

- Includes sentiment scores and lexical/semantic features

- Limitations:

- Very small scale (1,142 headlines)

- Proprietary sentiment scoring method

c) Time-series–oriented datasets

- Farimani dataset

- Integrates latent economic concepts, news sentiment, and technical indicators

- All data structured as time series

- Limitation: Sentiment mainly tied to FX news, limited trading depth

- SEntFiN 1.0 (Sinha et al.)

- Entity-level sentiment annotations

- Rich financial entity coverage

- Limitations:

- Missing timestamps

- Headline-only text

- Insufficient scale for robust training

d) Large-scale news datasets

- Philippe dataset (Bloomberg & Reuters)

- Large financial news time series

- Limitation: No entity-level sentiment labels, raw news only

- Finnhub dataset

- Time-aligned stock prices and related news via API

- Limitation:

- Proprietary access

- No built-in sentiment labels

- Lacks systematic quality evaluation

e) Recent hybrid approaches

- Combine numerical market data with social media text

- Use deep reinforcement learning for stock prediction

- Introduce dynamic datasets for model evaluation

- Limitation: Often dataset-specific and not openly accessible

f) FNSPID dataset

- Covers 1999–2023

- Multilingual news (English & Russian)

- Time-aligned financial news and stock prices

- Designed for:

- Sentiment analysis

- Stock price prediction

- Data quality:

- Sourced exclusively from trusted financial platforms (e.g., NASDAQ)

- Mitigates fake news concerns

- Emphasizes dataset reliability and integrity

g) Open-access challenge

- Many high-quality datasets and models (e.g., FinChat, BloombergGPT)

- Restricted or proprietary

- Limited availability for academic research

- FNSPID objective

- Provide a comprehensive, open, and accessible dataset

- Enable broader and more inclusive research in financial modeling

3. Constructing FNSPID

Curated integration of numerical stock data + sentiment data

Construction divided into three tasks:

- Task 1: “Full sentiment + numerical” dataset

- Task 2: “Summarized” sentiment dataset

- Task 3: “Quantified” sentiment dataset

a) Data sources

- Numerical data

- Stock prices collected via Yahoo Finance API

- Sentiment / news data

- Explored multiple financial news sources

- e.g., Bloomberg, Reuters, Yahoo Finance, Forbes, CNBC

- Due to usage restrictions, primary collection from NASDAQ

- Explored multiple financial news sources

b) NASDAQ data collection pipeline

- Two-stage process:

- Step 1) Collect headlines and URLs for each stock using Selenium

- Step 2) Extract full news content from URLs

- Ensures structured textual data aligned with stock-level information

c) Data diversity and integrity

- To reduce source bias and improve coverage:

- Integrated previously processed datasets from:

- Bloomberg

- Reuters

- Benzinga

- Lenta

- Integrated previously processed datasets from:

- Combined with NASDAQ data to form [FNSPID Task 1]

d) Data ethics and compliance

- Strict adherence to robots.txt and website usage policies

- Only collected content that is:

- Freely accessible

- Not behind paywalls or subscriptions

- Web scraping used only when no official API was available

- Licenses of prior datasets verified before integration

(1) Data mining and processing

a) Data & Goal

- Raw data: Numerical prices, URLs, news headlines, full news text

- Goal:

- (1) Reduce text length

- (2) Preserve sentiment-relevant information

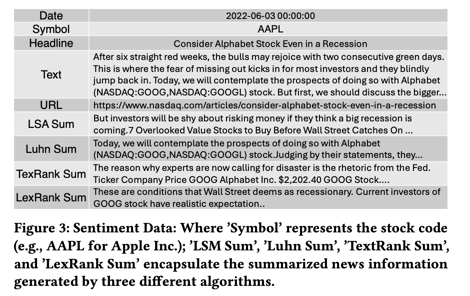

b) News summarization

- Motivation:

- Address token limits

- Improve practicality of downstream sentiment analysis

- Applied 4 rule-based summarization methods:

- LexRank / Luhn / Latent Semantic Analysis (LSA) / TextRank

- via the Sumy Python package

c) Stock-aware summarization

- Introduced a weight model \(W_f\)

- Emphasizes content relevant to the associated stock

- Summary length fixed to 3 sentences

- ≈ 1/8 of original article

- Balances conciseness and specificity

- Benefits:

- Significant reduction in token usage

- Improved ChatGPT prompt stability

- Completion of [FNSPID Task 2]

d) Sentiment quantification

- Limitation:

- Early LLMs and TS-DL models: Struggle with raw language understanding

- Large models (e.g., ChatGPT): Computationally expensive

- Observation:

- DL models can effectively utilize numerical sentiment signals

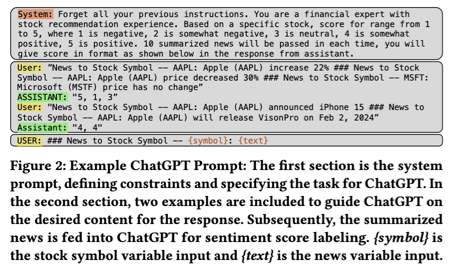

e) Sentiment labeling strategy

- Constructed a labeled subset:

- News from 50 major S&P 500 stocks

- Used ChatGPT to generate sentiment labels:

- Avoids costly manual annotation

- Outperforms traditional sentiment algorithms

- Input to ChatGPT

- LSA-based summaries for concise yet informative prompts

- Prompt configuration:

- Up to 10 entries per prompt

- Temperature = 0 for output stability

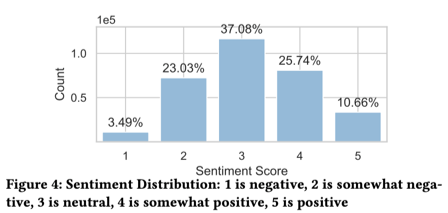

f) Sentiment scoring scheme

- Adopted a 1–5 discrete scale:

- 1: Negative

- 2: Somewhat negative

- 3: Neutral

- 4: Somewhat positive

- 5: Positive

- Rationale:

- More stable than alternatives (e.g., -1 to 1, 1 to 10)

- Decimal scores lead to unstable representations

- Sentiment distribution:

- Approximately normal

g) Normalization and integration

-

Sentiment scores: Normalized consistently with other features

\(\rightarrow\) Ensures sentiment contributes meaningfully (w/o dominating model training)

h) Handling missing sentiment data

- Issue: Days without news articles

- Solution:

- Exponential decay toward neutral sentiment

- Formula:

- \[S(t) = 3 + (S(0) - 3)\cdot e^{-\lambda t}\]

- Configuration:

- Neutral target = 3

- Decay rate \(\lambda = 0.03\)

i) Daily aggregation

- Multiple news articles on the same day

- Use average sentiment score

- Motivation:

- Balanced representation of daily market sentiment

- Reduces bias from extreme individual news items

4. FNSPID Property

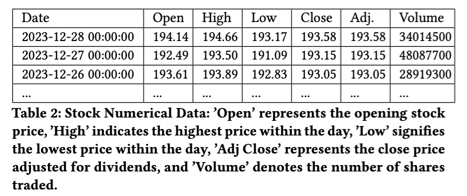

a) Dataset overview

- Large-scale and diverse dataset:

- 30+ GB of processed data

- [TS] Numerical price data (Table 2)

- [Text] Sentiment-related data (Figure 3)

- URLs

- News headlines

- Full news text

- Sentiment scores

- Summaries from four methods

b) Data richness and diversity

- Multi-modal structure:

- Numerical prices

- Textual news (+ quantified sentiment)

c) Computational effort

- For dataset construction…

- ~4 TB of computing resources

- ~45 days of processing time

d) Labeled sentiment subset

- Focused analysis on: Top 50 influential S&P 500 stocks (2024)

- Result: 402,546 news articles with sentiment labels

4-1. Evaluation

Evaluation of FNSPID

- Assesses linguistic, semantic, and temporal properties

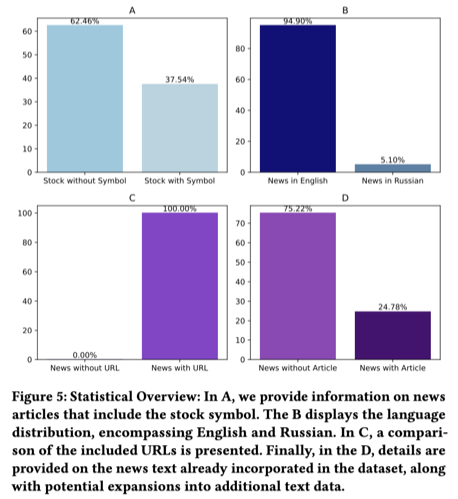

Language distribution

- Pproportions of English Russian content

- Highlights the multilingual nature of FNSPID

News article segmentation

- (1) Stock-symbol–referenced news

- (2) Non–stock-symbol news

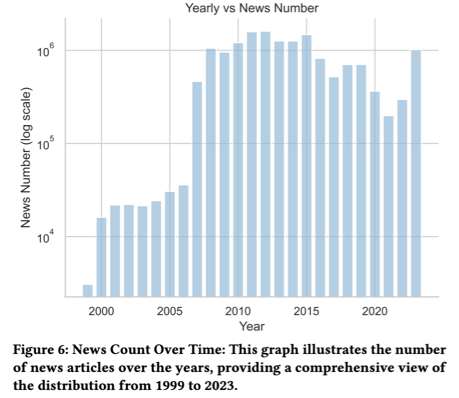

Temporal distribution

- Date: 1999 to 2023

- Identifies long-term trends and fluctuations in financial news coverage

Overall assessment

- a) Large scale

- b) Multilingual coverage

-

c) Long temporal span

-

Well-suited for:

- Financial sentiment analysis

- Time-series forecasting

5. Experiment

- Effectiveness of FNSPID in stock price prediction

- Focuses on how the quantity of news data influences model performance

5-1. Quantity Test

Goal

- Analyze the impact of training data size on short-term stock price prediction

- Use FNSPID Task 3 as the experimental benchmark

Input information

- (1) Numerical features

- Open price

- Close price

- Trading volume

- (2) Sentiment features

- Included or excluded depending on the experiment setting

Models

- Traditional DL methods: RNN / LSTM / GRU / CNN

- TS–oriented models: 4-layer Vanilla Transformer / 4-layer TimesNet

Experimental setup

- Input window: 50 days

- Prediction horizon: 3 days

- Training epochs: 100

- Training dataset sizes

- 5 stocks (n = 11,277)

- 25 stocks (n = 43,192)

- 50 stocks (n = 127,937)

- Evaluation

- Conducted on 5 stocks

- One outlier removed

- Final results reported as averaged values

Test results

-

Evaluation metric: \(R^2\)

-

Experiment settings

- A-Sen: Sentiment info (O)

- A-Non: Sentiment info (X)

Key findings

- Average \(R^2\) improvement of 6.29% when increasing training data from 5 to 25 stocks across all models

Observations

- Transformer-based models > Recurrent models

- Larger training datasets significantly enhance prediction accuracy

- Small datasets limit performance in financial forecasting tasks

Conclusion

- Robustness and applicability of FNSPID

- Importance of data scale in financial TS prediction

- Effectiveness of Transformer-based architectures for stock price forecasting

5-2. Quality Test

Goal

- Evaluate the impact of sentiment quality on model training performance

- Compare sentiment sources derived from FNSPID Task 3, FNSPID Task 2, and TextBlob

Experimental setup

- Sentiment sources

- FNSPID Task 2

- ChatGPT-labeled sentiment

- TextBlob sentiment

- Based on rule-based scoring & lightweight NLP models

- FNSPID Task 2

- Benchmark

- Sentiment information from FNSPID Task 3

Overall findings

- Sentiment quality has a decisive impact on forecasting accuracy

- Results in Table 3

- Part A: FNSPID Task 2 sentiment improves prediction accuracy

- Part B: TextBlob sentiment degrades model performance

Impact on model performance

- Transformer-based comparison

- FNSPID Task 3 sentiment

- Accuracy improvement of +0.2% over non-sentiment input

- TextBlob sentiment

- Accuracy degradation of −1.16%

- FNSPID Task 3 sentiment

Sentiment effectiveness across models

- Transformer: Consistently benefits from high-quality sentiment information

- TimesNet: Occasionally exhibits positive gains

- RNN, LSTM, GRU, CNN

- Treat sentiment features as noise

- Show no consistent performance improvement

Dataset scale effects

-

Small-scale training

- LSTM outperforms Transformer when only 5 news items are available

-

Large-scale training

- Transformer exhibits substantial accuracy gains as data volume increases

<br>

Discussion

-

Hyperparameter alignment

- Uniform hyperparameter settings are used for fair comparison

- This constraint may suppress the optimal performance of individual models

<br>

-

Sentiment representation

- Sentiment scores mapped onto a 5-level scale

- Paragraph-level sentiment compression may discard fine-grained information

- Information loss contributes to limited sentiment effectiveness

<br>

-

Interpretation of limited gains

-

Financial news is known to influence stock prices

-

Marginal improvements arise due to

- Already high baseline prediction accuracy

- Delayed market reactions to news dissemination

-

<br>

Conclusion

-

Key takeaways from the Quality Test

- Dataset quality and quantity jointly determine forecasting performance

- High-quality sentiment information benefits Transformer-based models

- Transformer-based architectures outperform traditional time-series models and recent alternatives such as TimesNet in stock price prediction