Generative Learning for Financial TS with Irregular and Scale-Invariant Patterns

Contents

- Abstract

- Introduction

- Related Work

- Problem Statement

- FTS-DIffusion Framwork

- Pattern Recognition

- Pattern Generation

- Pattern Evolution

Abstract

Limited data in financial applications

\(\rightarrow\) Synthesize financial TS !!

- Challenges: Irregular & Scale-invariant patterns

( Existing approaches: assume regularity & uniformity )

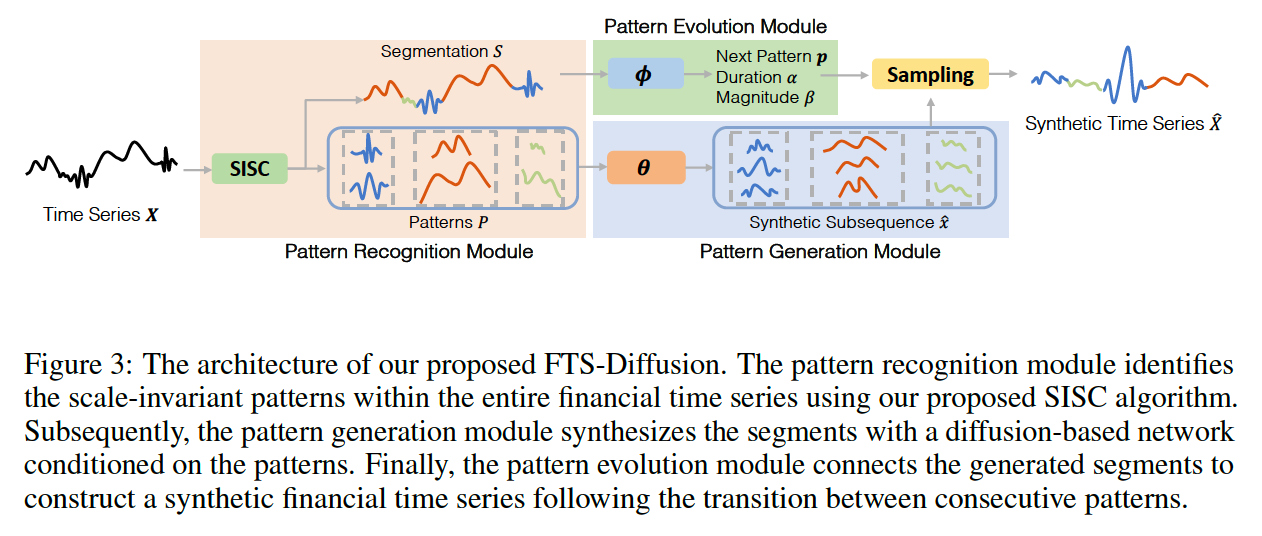

FTS-Diffusion

To model Irregular & Scale-invariant patterns that consists of 3 modules

- (1. Patterrn Recognition) Scale-invariant pattern recogntion algorithm

- to extract recurring patterns that vary in duration & magnitude

- (2. Pattern Generation) Diffusion-based generative network

- to synthesize segments of patterns

- (3. Pattern Evolution)

- model the temporal transition of patterns

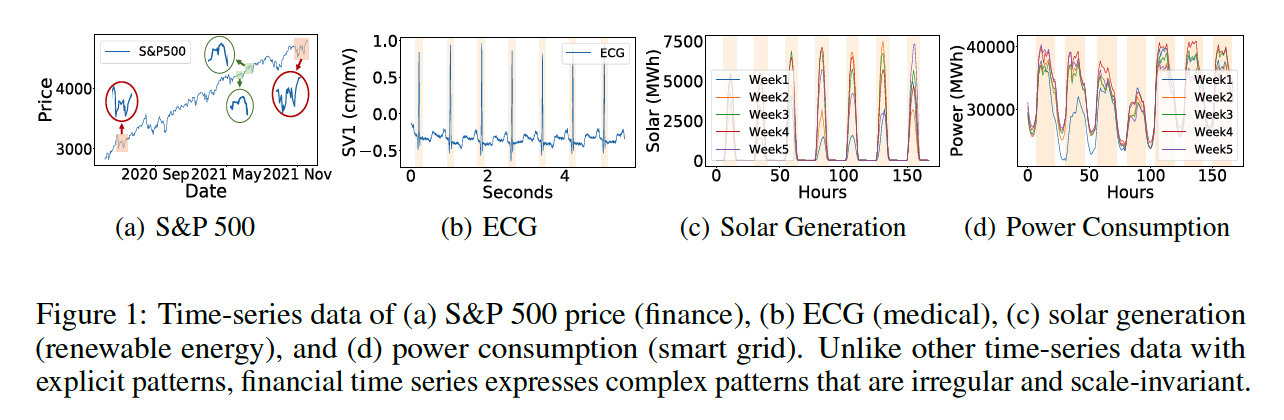

1. Introduction

Problem in Finance data

- (1) dearth of data & low signal-to-noise ratio

- (2) cannot run experiments to obtain more data

Solution: Data Augmentation, using diffusion model

Still, challenge in “finance TS” … Why??

\(\rightarrow\) Two reasons:

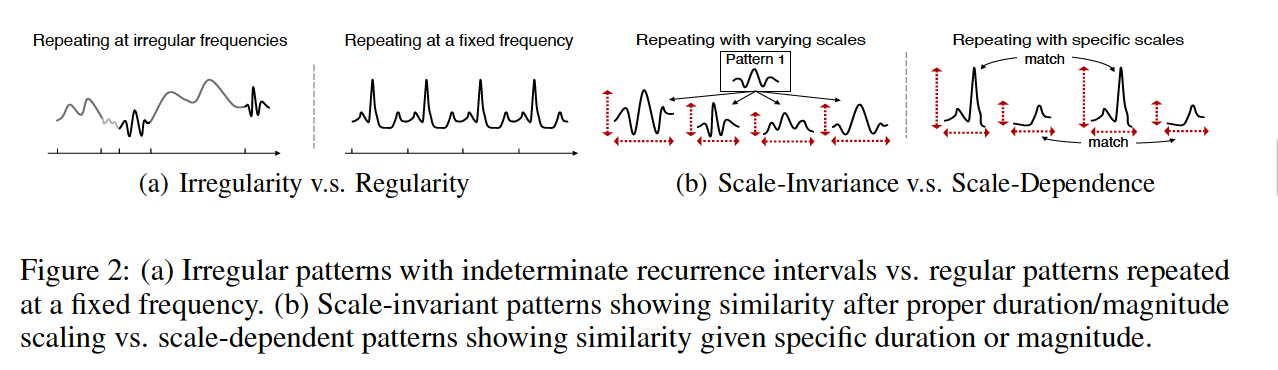

- (1) Lack of regularity

- (2) Scale-invariance

- financial TS appear to conatin more subtle patterns that repeat themselves with varyring duration and magnitude

Solution

Deconstruct financial TS into 3 prong process

- (1) Pattern Recognition

- to identify irregular & scale-invariant patterns

- (2) Generation

- to synthesize segments of patterns

- (3) Evolution

- to connect the generated segments

Contribution

-

Identify & Define 2 properties in TS finance

- Irregularity

- Scale-invariance

Propose novel FTS-Diffusion framework

-

Three modules

- (1) Pattern Recognition: based on SISC (Scale-Invariant Subsequence Clustering) algorithm

- incorporate DTW to capture irregular patterns

- (2) Generation: consists of a diffusion-baseed network

- conditional on the patterns learned by SISC

- (3) Evolution: made up of pattern transition network

- produce temporal evolution of consecutive patterns

- (1) Pattern Recognition: based on SISC (Scale-Invariant Subsequence Clustering) algorithm

-

Experiments on real world finance TS

2. Related Work

DGM (Deep Generative Modeling) in TS

- TimeVAE (2021): VAE to model trend & seasonality in TS

- RCGAN (2017) & MV-GAN(2020) : GAN for medical TS

- TimeGAN (2019): GAN for general TS

- QuantGAN (2020): GAN for financial TS

- CSDI (2021): Score-based diffusion … unconditional version can be used as generative model

- DiffWave (2021) & BinauralGrad (2022): Generate waveform TS with diffusion models

\(\rightarrow\) Common Limitation: Model TS with REGULAR patterns

3. Problem Statement

(1) Unique characteristics of Financial TS

Propose a novel framework to model (1) irregular & (2) scale-invariant TS

Notation

-

\(\boldsymbol{X}=\left\{\boldsymbol{x}_1, \ldots, \boldsymbol{x}_M\right\}\) : MTS of \(m\) segments

- \(\boldsymbol{x}_m=\left\{x_{m, 1}, \ldots, x_{m, t_m}\right\}\).

- Total Length: \(T=\sum_{m=1}^M t_m . \boldsymbol{x}_m\)

-

Sampled from a conditional distribution \(f(\cdot \mid p, \alpha, \beta)\)

- pattern \(p \in \mathcal{P}\),

- duration is scaled by \(\alpha\) and magnitude scaled by \(\beta\).

\(\rightarrow\) \(\boldsymbol{x}_m\) will be statistically similar to its underlying pattern \(p\) while allowing for adjustments in duration and magnitude.

To model the dynamics across patterns, we employ a Markov chain

- Tuple \((p, \alpha, \beta)\) : State

- \(Q\left(p_j, \alpha_j, \beta_j \mid p_i, \alpha_i, \beta_i\right)\) : State transition probabilities

(2) Problem Statement

Seek to operationalize the structure laid out in Sec. 3.1

No knowledge of …

- the segments \(\left\{\boldsymbol{x}_m\right\}_{m=1}^M\)

- the set of scale-invariant patterns \(\mathcal{P}\)

- the scaling factors \(\alpha\) and \(\beta\)

- the transition probabilities \(Q\left(p_j, \alpha_j, \beta_j \mid p_i, \alpha_i, \beta_i\right)\).

Goal : develop a data-driven framework to accomplish the following:

- (Pattern Recognition)

- identify the patterns \(\mathcal{P}\)

- group segments into clusters according to their patterns \(p \in \mathcal{P}\);

- (Pattern Generation)

- learn the distribution \(f(\cdot \mid p, \alpha, \beta), \forall p \in \mathcal{P}\);

- (Pattern Evolution)

- learn the pattern transition probabilities \(Q\left(p_j, \alpha_j, \beta_j \mid p_i, \alpha_i, \beta_i\right)\).

4. FTS-Diffusion Framework

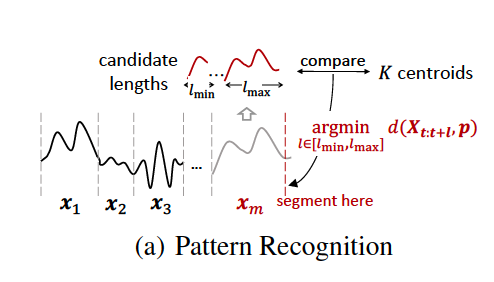

(1) Pattern Recognition

Goal: Identify Irregular & Scale-invariant patterns

Propose novel Scale-Invariant Subsequence Clusterint (SISC) algorithm

-

To partition entire TS into segments of variable length … itno \(K\) clusters

( same cluster = similar shape (DTW-based) )

- Use K-means

- Greedy segmentation strategy

Distance metric: \(d(\cdot, \cdot)\)

- DTW: Robust to varying lengths & magnitudes

- \(D T W(\boldsymbol{x}, \boldsymbol{y}):=\min _{A \in \mathcal{A}}\langle A, \Delta(\boldsymbol{x}, \boldsymbol{y})\rangle\).

- \(A\) : Alignment between two sequences in the set of all possible alignments

- \(\Delta(x, y)=\left[\delta\left(x_i, y_j\right)\right]_{i j}\) : Pointwise distance matrix between two sequences \(\boldsymbol{x}\) and \(\boldsymbol{y}\).

(2) Pattern Generation

Goal: Learn pattern-conditioned temporal dynamices

Propose a pattern generation module \(\theta\)

[First network] Pattern-conditioned diffusion network

- Conditional denoising process

- Forward: \(\boldsymbol{x}^N=\boldsymbol{x}^0+\sum_{i=0}^{N-1} \mathcal{N}\left(\boldsymbol{x}^{i+1} ; \sqrt{1-\beta}\left(\boldsymbol{x}^i-\boldsymbol{p}\right), \beta I\right)\)

- Backward: \(\boldsymbol{x}^0=\boldsymbol{x}^N-\sum_{i=0}^{N-1} \epsilon_\theta\left(\boldsymbol{x}^{i+1}, i, \boldsymbol{p}\right)\)

[Second network] Scaling AE

- learn the transformation btw variable length \(x\) and fixed length \(x^{0}\)

\(\rightarrow\) Jointly train two networks

- \(\mathcal{L}(\theta)=\mathbb{E}_{\boldsymbol{x}_m}\left[ \mid \mid \boldsymbol{x}_m-\hat{\boldsymbol{x}}_m \mid \mid _2^2\right]+\mathbb{E}_{\boldsymbol{x}_m^0, i, \epsilon}\left[ \mid \mid \epsilon^i-\epsilon_\theta\left(\boldsymbol{x}_m^{i+1}, i, \boldsymbol{p}\right) \mid \mid _2^2\right]\).

(3) Pattern Evolution

Pattern evolution network

\(\left(\hat{p}_{m+1}, \hat{\alpha}_{m+1}, \hat{\beta}_{m+1}\right)=\phi\left(p_m, \alpha_m, \beta_m\right)\).

- where \(\left(\hat{p}_{m+1}, \hat{\alpha}_{m+1}, \hat{\beta}_{m+1}\right)\) denotes the next pattern & scales in length and magnitude.

Loss function

- \(\mathcal{L}(\phi)=\mathbb{E}_{\boldsymbol{x}_m}\left[\ell_{C E}\left(p_{m+1}, \hat{p}_{m+1}\right)+ \mid \mid \alpha_{m+1}-\hat{\alpha}_{m+1} \mid \mid _2^2+ \mid \mid \beta_{m+1}-\hat{\beta}_{m+1} \mid \mid _2^2\right]\).